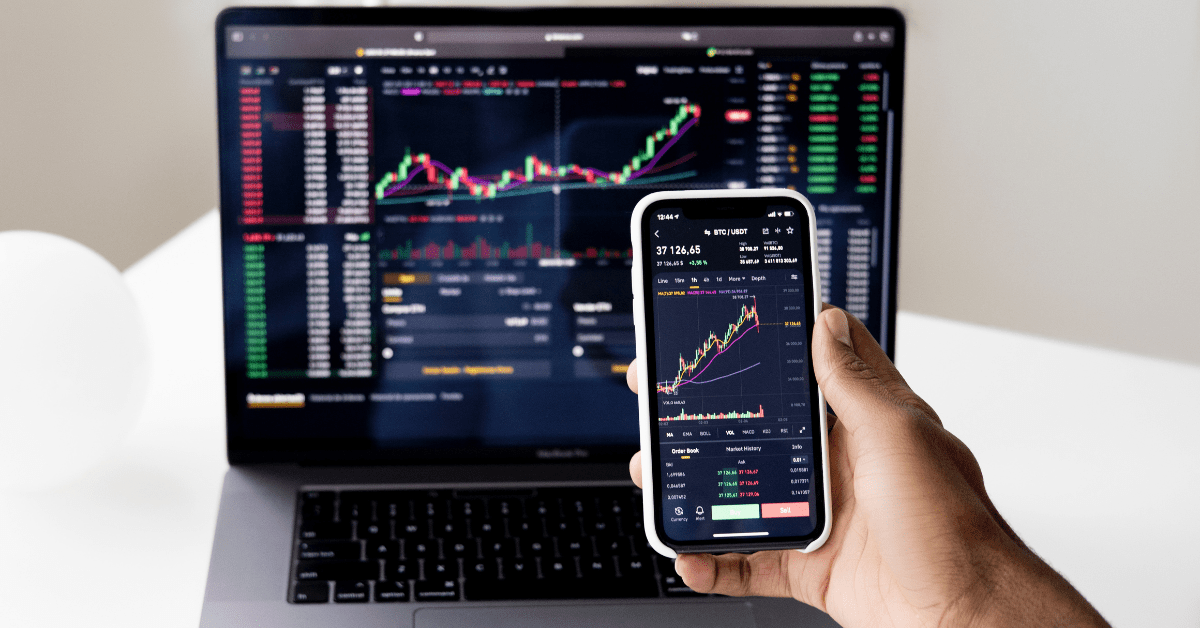

Time is the most valuable thing in trading. Time frame is a period used to measure how long it takes for an event to occur. It’s important because this will determine when you open and close your position, known as risk management.

Time frames explained

1-minute chart

The most popular time frame for day trading is the 1-minute tick, or even tick data charts.

Stock exchanges provide this type of data feed to brokers who can provide it to their clients.

This type of data might seem sensitive for some clients because it’s a concise term. However, be aware that this is nothing compared to what high-frequency traders receive.

An important thing to remember here is that the lower the time frame, the more trades are generated per period, which means they have less weight in terms of size, yet they have a more significant impact on the market.

15-minute chart

The next time frame is the 15-minute chart mainly used by swing traders and some day traders.

This type of data feed will show you all orders up to 15 minutes delayed, meaning that if a trade was put on at 8:00 am, then the order would only register on your screen at 8:15 am due to timings. Once again, this might not be ideal for some people.

However, it’s important to note that high-frequency trading has extreme short-term market impact and thus generates more than enough trades per period, so any delay here means little in terms of real-world activity.

30-minute chart

The next level up from the 15-minute chart would be the 30-minute chart commonly used by traders involved in swing trading or day trading larger time frames like daily, weekly or monthly charts (which requires around a one-month delay), etc.

This type of data feed will show you all orders up to 30 minutes delayed, meaning that if a trade was put on at 8:00 am, then the order would only register on your screen at 8:30 am due to timings. Once again, this might not be ideal for some people.

However, it’s important to note that high-frequency trading has extreme short-term market impact and thus generates more than enough trades per period, so any delay here means little in terms of real-world activity.

Institutions often use these time frames to hide their intent when they place their orders.

Daily chart

The most popular time frame used when trading with daily charts would be the 5-minute chart which takes around one month to generate enough data to trade it.

It means that if a trade was put on at 8:00 am. Then it will only appear on your screen at 8:30 am due to timings (unless you’re using high-frequency data feeds, of course).

Now, while this is sensitive short-term information, it needs to be used in the right way by traders who are not involved with high-frequency trading.

Weekly chart

The next time frame after daily charts would be weekly charts which can take one month up until two months for enough data to gather depending on the time frame you’re using (usually 5 minutes, 15 minutes or 1 hour).

Meaning, that if a trade were put on at 8:00 am, it would only appear on your screen at 8:30 am due to timings.

Now, while this is sensitive short-term information, it needs to be used in the right way by traders who are not involved with high-frequency trading.

Day chart

The most popular time frame used when trading day charts would be the 1-minute chart which takes around one month up until two months for enough data to gather depending on the time frame you’re using (usually 5 minutes, 15 minutes or 1 hour).

It means that if a trade was put on at 8:00 am. It will only appear on your screen at 8:30 am due to timings (unless you’re using high-frequency data feeds, of course).

Link to Saxo bank Dubai for more information.